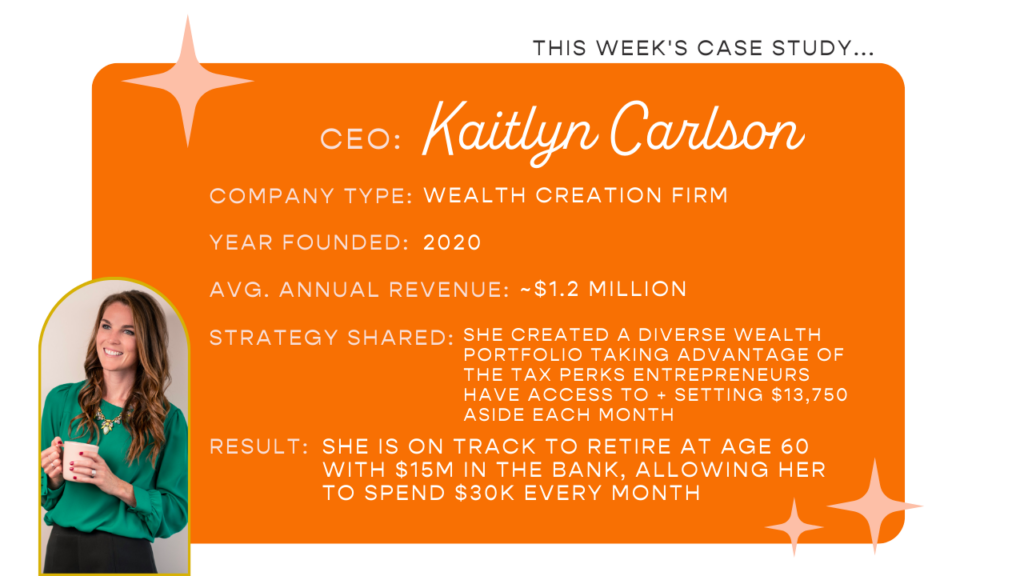

Kaitlyn Carlson Will Retire With $15M in the Bank: Check Out the Juicy Details Behind This Wealth Advisor’s Personal Wealth-Building Strategy

May 8, 2023

Kaitlyn Carlson is the brains behind Theory Planning Partners, a boutique firm that helps female entrepreneurs establish a wealth-building strategy and plan for financial independence—i.e. retirement. In fact, our founder Ellen Yin trusts Kaitlyn with her own finances!

Today, wealth advisor Kaitlyn Carlson is sharing her REAL household finances (yeah, you read right)!

This is our most financially juicy case study ever (even more than our quarterly income reports), featuring the behind-the-scenes details of this wealth advisor’s strategy to save $15 MILLION by the time she retires.

Kaitlyn’s Cubicle to CEO® Story

Kaitlyn had always known she was a numbers kind of gal, but she also wanted to integrate her love for finance with another passion.

“I discovered what financial advisors did, and I loved how it was a combination of finance and psychology,” she shares.

After a couple of years in asset management at Putnam Investments, Kaitlyn transitioned to wealth management at UBS Financial Services Inc. She started as a wealth planning analyst, working with more than 300 clients in the Southwest, and eventually became a private wealth advisor.

“That’s when I started working with the billionaires and centi-millionaires and learned how the wealthiest families in our country steward their wealth,” says Kaitlyn.

Fast forward 10+ years in the industry, and Kaitlyn has become a financial guru of sorts.

- Certified Financial Planner™️ (CFP®) – CHECK!

- Certified Exit Planning Advisor™️ (CEPA™️) – CHECK!

- Accredited Wealth Management Advisor (AWMA®) – CHECK!

In fact, today Kaitlyn is the founder and CEO of her own business, Theory Planning Partners, and she’s sharing her expertise with a very specific clientele…

“I built Theory off of everything that I didn’t see in the wealth management industry—the first of which was women,” says Kaitlyn.

Out of Kaitlyn’s 300 clients at UBS Financial, NOT ONE was a woman.

“Theory’s mission is to help female entrepreneurs create wealth,” she shares.

Kaitlyn is so committed to her mission that today she’s sharing with our audience of female entrepreneurs her personal wealth-building strategy.

If you’re not on the edge of your seats already, lean in, ladies. Let’s talk $$$!

Introducing This Wealth Advisor’s Personal Wealth-Building Strategy…

Let’s start with a little highlight reel. Here is Kaitlyn’s current budget:

Kaitlyn’s Income: $12,000/mo.

Jake’s Income: $10,750/mo.

Total Income: $23,750/mo.

Living Expenses: $12,000/mo.

(NOTE: Kaitlyn dives into how she built up her income as well as details around her $36,000 emergency savings in the podcast episode, so be sure to listen for those extra nuggets of gold!)

Now, we’ll take a look at her retirement goals:

Retirement Age: 60

Retirement Income: $30,000/mo.

Total Retirement Savings: $15 Million

So, where did these numbers come from?

“Wealth isn’t one specific number. Wealth is the luxury of choice,” Kaitlyn says.

Kaitlyn didn’t randomly select 60 or 30,000 or even 15 million because she learned it from a mentor or read it in a reputable publication. She chose these numbers because they give her and her family the luxury of choice—today and in the future.

Kaitlyn believes it’s important to create a budget that allows you to live your life, as in YOUR life, and this wealth advisor’s personal wealth-building strategy is built on that foundation.

Goal #1: Retire at 60

For some of you, “60” may seem like an unusual retirement age for a female entrepreneur. In fact, our previous podcast guest—real estate expert and money and mindset coach Erinn Bridgman—shared with us her plan to retire at age 40!

So, we asked Kaitlyn, “Why 60?”

“I tend to be more of a marathon runner than a sprinter when it comes to my financial independence,” says Kaitlyn. “I would rather have a nice, slow, steady 20–30 years to enjoy life today and sustainably build for a work-optional lifestyle at 60.”

Remember, wealth is not a number, it’s the luxury of choice.

Up until 60, this wealth advisor’s lifestyle will allow her to continue supporting female entrepreneurs, but she’ll also have time and money to take trips with her husband, Jake, and two sons.

After 60, Kaitlyn will have financially and mentally prepared for retirement with hobbies and activities she’s discovered outside of work—but she could keep working too!

“I really like what I do,” says Kaitlyn. “I could even see myself working to 70!”

Goal #2: Retire With $15M

When that 60th birthday rolls around, Kaitlyn plans to have saved $15 MILLION to live off of in retirement.

Once again, we asked the question you’re all dying to know: WHY THAT NUMBER?

“The short answer is I’m an Enneagram 3: The Achiever,” Kaitlyn laughs.

But, just for kicks, here’s the long answer…

There are three primary reasons Kaitlyn chose “$15 million” as her retirement savings goal.

- $15 Million = $30,000 per month

At retirement, Kaitlyn wants to maintain that “luxury of choice,” and the $30,000 per month income provides the spaciousness to pursue things that matter to her family…

The mortgage for their dream house,…

The freedom to travel,…

The ability to support causes they care about,…

The funds to send their boys to college…

“Twelve thousand is daycare, mortgage, insurance… It’s all of the responsibilities,” says Kaitlyn. “Thirty thousand felt like enough spaciousness to have flexibility right now.”

And, Kaitlyn says, even if she and Jake discover $15,000 a month is a more realistic budget for retirement versus $30,000, it just means they’ll hit that “work-optional” lifestyle sooner!

- $15 Million = Avoids the estate tax limit

Another reason Kaitlyn selected “$15 million” is because that size of portfolio keeps her and Jake below the estate tax limit.

“Each individual has an estate tax exclusion, and right now it’s about $12 million per person,” says Kaitlyn. “So if a married couple had $30 million, they would have to pay estate tax on anything above their exclusion amount ($24 million).”

Kaitlyn clarifies that the current estate tax limit of $12 million will drop to roughly $7 million at the end of 2025. She adjusts that number to $8 million for inflation, which means she and Jake will need to keep their portfolio below a collective $16 million to avoid the estate tax.

“It’s just simpler to stay under the estate tax so you don’t have to deal with that,” she adds.

- $15 Million = Happiness

Kaitlyn has worked with A LOT of ridiculously wealthy families, and along the way, she’s confirmed the cliche: Money doesn’t buy happiness.

Or rather… [MORE] money doesn’t buy happiness.

“I’ve worked with people that have $500,000,000,” says Kaitlyn, “but I typically find the happiest people have between $5 and $20 million. It’s enough for a very nice lifestyle, but not so much that it’s going to create dysfunction and confusion.”

A Wealth Advisor’s Wealth-Building Strategy

To reach her goal of $15 million by 60, Kaitlyn and Jake have to save $13,750 every month today.

(Here comes the math.)

First of all, $13,750 per month (or $360K per year) assumes a 6.5% return on Kaitlyn and Jake’s investments.

“I would say 8% is realistic for the US stock market,… but I like 6.5%,” says Kaitlyn (Hello, Enneagram 3).

To reach that savings goal, Kaitlyn diversifies (a wealth advisor’s favorite word).

“Diversification is going to help us navigate any economic environment,” says Kaitlyn. “So I’ve created three buckets: a tax-deferred bucket, a tax-free bucket, and a taxable bucket.”

- Tax-deferred bucket = 401(k)s

In 2023, the annual employee contribution limit for 401(k)s is $22,500.

“Both Jake and I are maxing out that $22,500 each,” says Kaitlyn.

According to Kaitlyn, this savings vehicle is “low-hanging fruit.”

“That money is going to grow without being taxed for a long period of time (until you go to take it out),” she says. “It compounds faster because the earnings aren’t getting taxed every year.”

If your employer provides an attractive employer match (when they contribute up to a certain percentage of your retirement contributions), the fruit is even sweeter.

Of course, both Kaitlyn and Jake are taking advantage of their employer matches.

“My employer match is 3% ($4,320), and Jake’s is 5% ($6,450).”

QUICK TIP: “For those of you who are single-member LLCs, being able to fund a solo 401(k) plan up to $66,000 is a huge, really cool savings vehicle you can take advantage of,” Kaitlyn shares.

- Tax-free bucket = IRA + Roth IRA

Kaitlyn’s second bucket requires a little more creativity…

“Our income phases us out of the ability to contribute directly to a Roth IRA, but there’s a workaround called the ‘backdoor Roth,’” she explains.

Technically, a “backdoor Roth” isn’t a specific retirement plan; it’s a strategy.

“We both contribute after tax to a regular IRA, and then we move that money into a Roth IRA, so that’s after-tax dollars going into an investment vehicle that’s never going to be taxed again,” says Kaitlyn. “I repeat: NEVER going to be taxed again.”

With this wealth-building strategy, Jake and Kaitlyn are able to contribute $6,000 each to their Roth IRAs every year.

“Even though that doesn’t seem like a life-changing amount of money, over 30 years that can compound into a large sum of money and that doesn’t get taxed and can be passed on to our kids as a tax-free bucket.”

- Taxable bucket = Investment accounts

Kaitlyn and Jake’s final taxable bucket is after-tax dollars going into regular ole’ investment accounts.

“That money gets taxed every year so it can grow a little bit slower, but we can access it at any time.”

For this bucket, Kaitlyn and Jake are contributing a collective $8,100 a month—then they let it sit.

“One of my favorite reasons for investing in the market is it’s an entirely passive wealth-creation vehicle,” says Kaitlyn. “As a mom of two young boys, it’s really nice not to have one more thing to do.”

In fact, Kaitlyn and Jake make saving for retirement even easier for themselves by setting auto contributions.

“I make this as thoughtless as possible,” says Kaitlyn. “The more you automate and the less you think about it, and the more likely it’s going to be achieved.”

BONUS TAX TIPS: It Pays To Be An Entrepreneur

In addition to the wealth of information (pun intended) Kaitlyn offers us regarding her personal wealth-building strategy, she’s leaving us with three tax-saving strategies for entrepreneurs.

- Getting children on the payroll – “One strategy I’m really excited to implement is eventually getting our children on the payroll,” says Kaitlyn. “We can pay them up to $12,000, and that’s also the standard deduction, so essentially they don’t have to claim that as income, and we can start funding their Roth IRAs.”

- Real estate investing – “Real estate is a cool option for entrepreneurs as well,” says Kaitlyn. As a mom of two boys under two and a half, Kaitlyn hasn’t personally jumped into real estate investing (yet). However, our last podcast guest, Erinn Bridgman, provided LOTS of specific tips from her own real estate investing journey to help you get started!

- Retirement accounts – “Entrepreneurs have the ability to do mega backdoor Roths, which is a super cool strategy,” says Kaitlyn. “You could potentially put up to $66,000 into retirement accounts, where employees are capped at $22,500. There are a lot of retirement accounts out there that are available to entrepreneurs.”

As with many of our podcast guests, we need to close with some important context: Kaitlyn is an expert wealth advisor with 10+ years in the industry AND her own firm.

“My husband and I learned from 22 years old on how the market worked—the nuances, the risk, and how to manage that accordingly,” says Kaitlyn. “I’m just so comfortable with it that it’s essentially second nature for me.”

Every entrepreneur’s wealth-building strategy will look different because every entrepreneur is different.

“Wealth creation is part art, part science,” Kaitlyn adds. “There’s no one way to do it. There’s a way that feels good to YOU.”

As you continue following along in our retirement series, see what feels good to you, and lean into that strategy. Do you, girl!

Thank you to our sponsors:

- Subscribe to Natasha Samuels’ show, The Shine Online Podcast, and check out the rest of episode 71 HERE

- Try your first 7 days of Honeybook free (no credit card required) + save 35% on your first year of ANY plan when you sign up with our link