THIS Is The Retirement Plan That Private Wealth Advisors Recommend To Entrepreneurs

October 30, 2023

Small business owners are the backbone of America. In exchange for taking on the risks and challenges of entrepreneurship, the US government rewards entrepreneurs with a wealth of options when it comes to retirement planning. While employees often rely on the 401(k) offered by their companies, business owners have access to a diverse range of retirement solutions, including SEP IRAs, Solo 401(k)s, as well as defined contribution and defined benefit plans. With this extensive menu of choices, it’s crucial for entrepreneurs to be in contact with private wealth advisors, and gain an awareness of the solutions available to them.

Of all of these options, there is one that financial advisors recommend above the rest.

Traditionally, many business owners have been advised to opt for SEP IRAs, which stands for Simplified Employee Pension Individual Retirement Account, simply because their CPAs are reasonably familiar with this solution. However, CPAs don’t have the extensive knowledge on all the options available to entrepreneurs that competent private wealth advisors do.

A solo 401(k), in contrast, offers an array of benefits, making it a more attractive retirement plan. It shares similar contribution limits as a SEP IRA, but stands out for its versatility. Here are two reasons you should consider a Solo 401(k) as your retirement solution.

Higher Contribution Limits

One of the standout advantages of a Solo 401(k) is its exceptionally high contribution limits, especially when compared to other retirement plans like SEP IRAs. With a Solo 401(k), you’re afforded the unique ability to make contributions both as an employee and as an employer. This dual-contribution capability sets it apart from many other retirement plans.

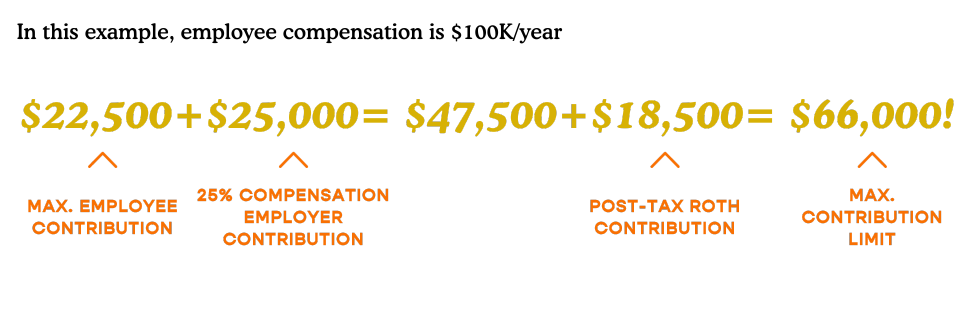

As an employee, you can contribute a substantial amount to your Solo 401(k). For instance, in 2023, the annual contribution limit for an employee is set at $22,500. However, the real magic happens when you consider the employer contributions.

As the employer, you can contribute up to 25% of your compensation. This means that, when your business is performing well, you have the ability to make additional substantial deposits, beyond what you could do as an employee. The combination of these two contribution avenues makes it significantly easier for high-earning business owners to reach the maximum annual contribution limit, which is set at $66,000 for 2023.

Incredible Tax Benefits

One of the other key advantages of a Solo 401(k) is the flexibility it offers regarding contributions. As a business owner, you can contribute both pre-tax and post-tax dollars to your Solo 401(k) account. This dual contribution feature provides you with a higher degree of control over your retirement savings and tax strategy.

The real brilliance lies in the “Mega Backdoor Roth” strategy that becomes possible due to the Solo 401(k)’s flexible contribution structure. Through this strategy, business owners can make after-tax contributions to their Solo 401(k). The after-tax contributions serve as a gateway to converting these funds into a Roth account.

Why is this significant? It’s because Roth accounts are renowned for their tax advantages, offering tax-free growth and tax-free distributions in retirement.

Now, let’s break down how this works: Suppose you’ve contributed the maximum employee contribution limit for 2023, which is $22,500, AND you’ve maxed out the 25% compensation contribution as the employer. Through the “Mega Backdoor Roth” you can actually add more money to this account post-tax to bring it up to the maximum contribution limit of $66,000 within a single year!

By embracing a solo 401(k) and understanding these strategic nuances, entrepreneurs can optimize their retirement plans, ensuring financial security while enjoying the numerous rewards of entrepreneurship. With this strategy in place, business owners can accomplish in one year what might take employees nearly a decade to achieve. For these reasons, and so many more, private wealth advisors continue to recommend this retirement option for many business owners.

If you’re curious what other retirement strategies look like, here is how our favorite wealth advisor, Kaitlyn Carlson, has set herself up to retire with $15M in the bank!

We also recommend you book a call with her wealth creation firm, Theory Planning Partners!

Want to hear more insight from Kaitlyn, and get the details of our Q3 2023 income report? Listen to episode 218 of Cubicle to CEO – available everywhere you listen to podcasts!